The Broader Market Context

The latest data snapshot comes at a moment of volatility for global financial markets. After months of speculation, optimism surrounding potential interest rate cuts by the Federal Reserve appears to be fading. Recent economic indicators — including sticky inflation prints and stronger-than-expected labor market data — have dampened expectations of an aggressive monetary easing cycle.

For risk assets such as cryptocurrencies, this shift is highly consequential. Bitcoin and Ethereum, which have increasingly correlated with equities during periods of monetary uncertainty, reacted by giving up part of their September gains.

- Bitcoin (BTC) dropped 3.4% during the week, sliding from about $112,000 to $109,000 before recovering slightly to trade near $114,000.

- Ethereum (ETH) also softened, falling back toward the $4,189 level.

The weakness translated into institutional positioning, with both Bitcoin and Ethereum investment vehicles experiencing some of their largest redemptions of the year.

Bitcoin Outflows: $719 Million in a Week

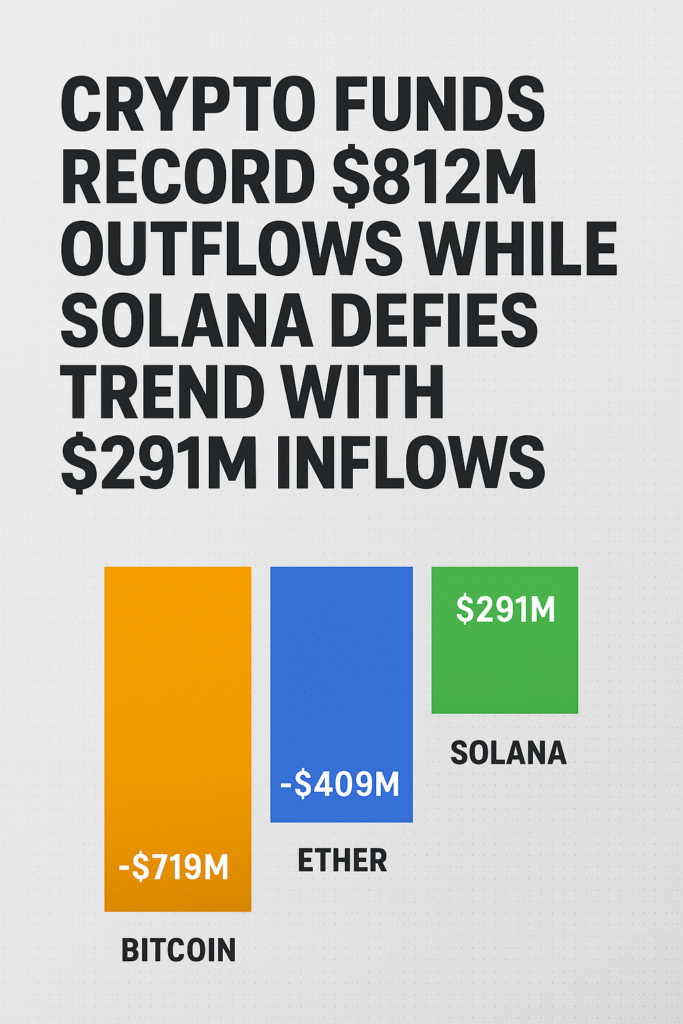

As the oldest and largest cryptocurrency, Bitcoin remains the bellwether for institutional flows. Last week, Bitcoin-linked ETPs recorded $719 million in outflows, a clear signal that large investors were locking in profits or hedging against further downside.

Bitcoin’s price action has been particularly sensitive to shifts in bond yields and dollar strength. With U.S. Treasury yields climbing in September, the opportunity cost of holding non-yielding assets such as Bitcoin increased. Many funds managing diversified portfolios may have opted to reduce BTC exposure in favor of safer, income-generating instruments.

Another factor influencing sentiment is the concentration of Bitcoin holdings among a few institutional players. For example, Strategy Inc. (formerly MicroStrategy), the largest corporate holder of BTC, recently announced a modest $22 million purchase, bringing its total holdings to over 640,000 BTC. While the move reaffirmed long-term corporate interest, it also highlighted a slowdown in institutional accumulation.

Ethereum Outflows: $409 Million Amid ETF Uncertainty

Ethereum also suffered heavily, with $409 million in weekly outflows. This is significant because ETH has been positioning itself as the second-most likely candidate for widespread institutional adoption via ETFs.

Earlier in the year, Ethereum ETFs were launched in multiple jurisdictions, sparking optimism that inflows would accelerate. However, the lack of decisive regulatory clarity in the United States has kept enthusiasm tempered. The SEC continues to review several Ethereum ETF filings, but with no immediate deadlines last week, traders may have opted to take profits.

Ethereum’s fundamentals also face scrutiny. Gas fees remain volatile, and while Layer-2 scaling solutions have improved throughput, institutional investors may be waiting for clearer proof that Ethereum can deliver sustainable transaction efficiency at scale.

Solana: The Lone Bright Spot With $291 Million Inflows

In stark contrast, Solana (SOL) investment products saw $291 million in inflows, a remarkable outcome given the broader market retreat.

Several factors are driving this surge in Solana interest:

- ETF Anticipation: Multiple firms have filed applications for U.S.-based Solana ETFs, with deadlines approaching in October. Institutional investors are positioning early, hoping to capture upside if the SEC approves even a single filing.

- Network Growth: Solana continues to expand its ecosystem, with strong adoption in decentralized finance (DeFi), non-fungible tokens (NFTs), and payment infrastructure. Its transaction speed and low cost make it a serious alternative to Ethereum.

- Institutional Rotation: As Bitcoin and Ethereum face outflows, some capital appears to be rotating into Solana as a speculative hedge. For many institutions, SOL offers exposure to a high-growth blockchain without the same level of entrenched competition.

At around $212 per token, Solana’s price has proven resilient, underlining confidence that ETFs could trigger a new wave of institutional adoption.

Total Assets Under Management (AUM) Decline

The sharp outflows reduced the total assets under management (AUM) across global crypto investment products from $241 billion to $221 billion. While still historically high, the $20 billion drop underscores the fragility of investor sentiment in the current environment.

Despite this setback, month-to-date inflows remain around $4 billion, and year-to-date inflows total nearly $40 billion. This suggests that while weekly flows are volatile, institutional appetite for digital assets is far from exhausted.

ETF Decisions: Why the Next Two Weeks Matter

Much of the market’s focus is now turning toward the U.S. Securities and Exchange Commission (SEC), which is expected to issue decisions on several high-profile ETF applications in October.

- Canary Capital’s Litecoin ETF has the first upcoming deadline.

- Other ETFs under review include products linked to XRP, Solana, Dogecoin, Cardano, and Hedera.

ETF analyst Nate Geraci described the upcoming period as potentially “enormous” for altcoin ETFs. A single approval could set precedent and open the door for a wave of institutional inflows across multiple assets.

Comparing Crypto With Traditional Asset Flows

The crypto market’s recent volatility mirrors patterns observed in other asset classes. For example:

- Gold ETFs also experienced redemptions last week as yields rose, indicating that Bitcoin may be increasingly trading like “digital gold” in the eyes of investors.

- Equity markets remain mixed, with U.S. stock indexes under pressure from macroeconomic uncertainty, creating a cautious environment for all risk assets.

The difference, however, lies in crypto’s higher beta. When markets move against risk, digital assets tend to swing harder, magnifying inflows and outflows.

Regulatory Landscape: U.S. vs. Europe

While the SEC dominates headlines in the United States, Europe is also reshaping its crypto regulatory framework. The European Union’s Markets in Crypto-Assets (MiCA) regulation is set to take effect, creating a standardized licensing regime across member states.

Poland, for instance, recently advanced its Crypto-Asset Market Act, sparking controversy over potential restrictions. Some lawmakers have criticized the law as overly burdensome, warning it could stifle innovation.

The regulatory divide between the U.S. and EU is critical. Whereas the EU is moving toward harmonization, the U.S. remains locked in case-by-case ETF decisions that fuel volatility in institutional positioning.

Investor Risks and Opportunities

Risks:

- Macroeconomic headwinds, particularly sticky inflation and high yields.

- SEC delays or denials of ETF applications.

- Continued correlation with equities, limiting diversification benefits.

Opportunities:

- Solana ETFs could ignite a wave of new institutional flows.

- Long-term adoption of blockchain infrastructure in payments, DeFi, and tokenization.

- Potential for record inflows in 2025 if regulatory clarity improves.

Conclusion: A Market in Transition

The $812 million outflow from crypto funds last week highlights the fragility of investor sentiment in the face of macro uncertainty. Yet, Solana’s $291 million inflows demonstrate that the market is far from monolithic. As investors rotate between assets, opportunities emerge for those positioned ahead of key regulatory milestones.

The next two weeks may prove pivotal. If even one altcoin ETF gains approval in the U.S., it could mark a turning point for institutional adoption, not only for Solana but for the broader ecosystem. Until then, traders should brace for heightened volatility as the crypto market navigates the intersection of macroeconomics, regulation, and innovation.