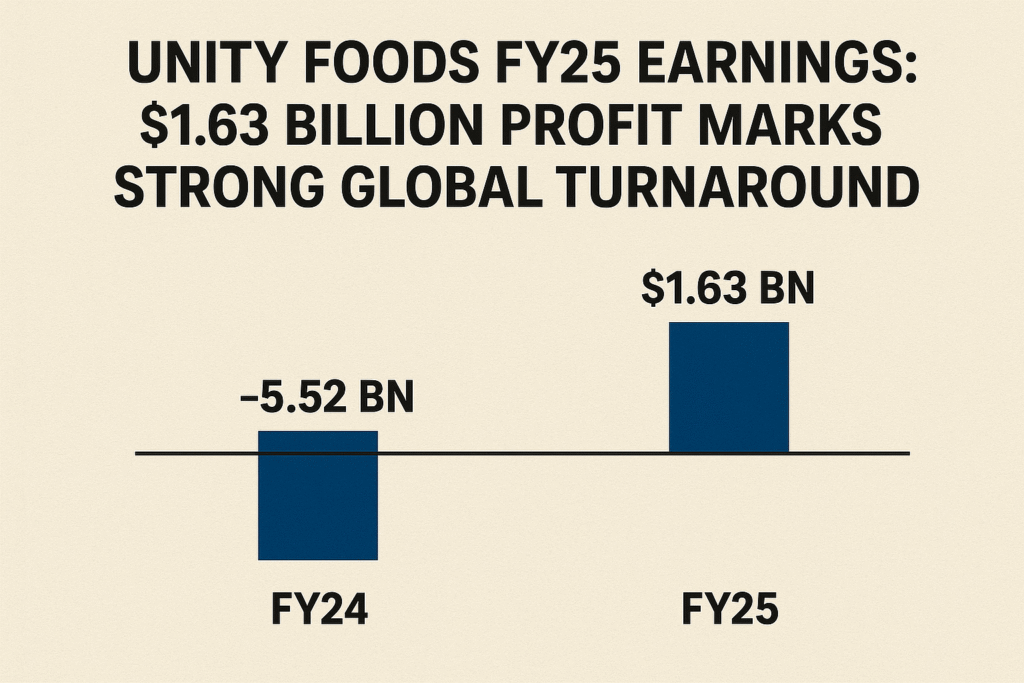

Unity Foods Limited has delivered one of the most significant financial turnarounds of the year, posting a consolidated net profit of $1.63 billion for the fiscal year ending June 30, 2025 (FY25). This sharp recovery contrasts with a net loss of $3.52 billion in FY24, underscoring the company’s ability to adapt, optimize, and reposition itself amid an unpredictable global business environment.

The performance not only reflects internal improvements in efficiency, margins, and financial discipline, but also demonstrates how the company is navigating larger industry forces such as fluctuating commodity prices, supply chain volatility, and changing consumer demands. With earnings per share (EPS) at $1.37, compared with a loss of $2.95 last year, Unity Foods has placed itself firmly back in the black and is sending a positive signal to investors, industry watchers, and competitors alike.

This detailed review will explore Unity Foods’ FY25 performance in depth — covering revenues, profitability, industry dynamics, global comparisons, investor sentiment, and future growth prospects.

Revenue and Sales Stability: A Hard-Won Achievement

In FY25, Unity Foods reported a gross turnover of $85.38 billion, showing a modest 1% increase compared with $84.50 billion in FY24. After deducting sales tax and discounts totaling $7.44 billion, the company achieved a net turnover of $77.94 billion, nearly flat compared with the previous year.

While some may view flat revenue as uninspiring, in the context of volatile global commodity markets and weakening demand in many food categories, maintaining steady turnover is a success. Global edible oil and food commodity players such as Bunge and Wilmar International have reported similar challenges in keeping revenues stable amid price swings.

Unity Foods’ ability to preserve its top line reflects both strong customer retention and a deliberate strategy of focusing on core markets, rather than chasing risky growth during a turbulent period.

Cost Control and Margin Expansion

One of the most impressive aspects of FY25 was Unity Foods’ margin recovery.

- Cost of sales fell by 6.7% to $66.53 billion, down from $71.30 billion last year.

- Gross profit rose sharply by 69%, reaching $11.41 billion compared with $6.75 billion in FY24.

- Gross profit margin climbed to 14.6%, from just 8.2% a year earlier.

This expansion came largely from tighter supply chain management, better procurement contracts, and a push toward higher-margin products. For perspective, global agribusiness majors often operate on thin margins — with ADM and Bunge averaging gross margins between 10% and 15%. Unity Foods’ achievement of 14.6% puts it on competitive footing with some of the largest players globally.

Expense Management: A Leaner Operational Model

The company also benefited from disciplined cost management.

- Selling and distribution expenses fell 7% to $2.23 billion.

- Administrative expenses dropped 7.8% to $1.27 billion.

This shows Unity Foods’ intent to run leaner operations, shedding excess spending while investing in areas that directly support profitability.

However, other operating expenses rose sharply to $864 million from $16 million last year — primarily due to currency adjustments, regulatory compliance, and extraordinary provisions. While this may appear concerning, such expenses were largely offset by a surge in other income, which proved to be one of the key profit drivers.

Other Income: A Strategic Advantage

Unity Foods recorded $2.80 billion in other income, more than doubling from the previous year. This included returns on financial investments, proceeds from asset sales, and gains from foreign exchange management.

In an era of rising interest rates and volatile financial markets, companies often see non-core income decline. Unity Foods’ success in this area demonstrates financial acumen and an ability to diversify revenue streams beyond core operations — a strategy increasingly favored by global investors who look for stability in uncertain times.

Operating Profit and Core Strength

Unity Foods’ operating profit surged by 118% year-on-year, reaching $9.89 billion compared with $4.54 billion in FY24. This figure is not only a reflection of operational improvements but also a strong indicator of long-term sustainability. Operating profit is often considered the most reliable measure of a company’s health because it excludes one-off financial windfalls or extraordinary costs.

By doubling its operating profit, Unity Foods has signaled to stakeholders that its turnaround is not cosmetic but rooted in core efficiency gains.

Finance Costs and Taxation

Finance costs declined by 5.6% to $7.02 billion. This reduction is notable given the backdrop of higher global interest rates, suggesting that Unity Foods has actively reduced its debt burden or refinanced at better terms. Lower financial leverage is expected to give the company more flexibility in future expansion and investments.

Profit before levies and taxation reached $2.86 billion, compared with a loss of $2.90 billion in FY24. After accounting for levies of $705 million and taxation of $851 million, Unity Foods reported a net profit of $1.31 billion from continuing operations. A further $326 million profit from discontinued operations boosted the consolidated net profit to $1.63 billion.

Industry Context: A Global Food Market Under Pressure

The FY25 financial year was a testing period for the global food and agribusiness sector. Unity Foods’ turnaround must be understood within this larger context.

- Commodity Price Volatility: Edible oil and sugar markets saw sharp swings due to weather disruptions, supply chain bottlenecks, and geopolitical events.

- Currency Fluctuations: With many raw materials priced in U.S. dollars, global food companies faced additional pressure on margins.

- Inflationary Pressures: Rising global inflation pushed up input costs, from packaging to energy, squeezing producers.

- Shifting Consumer Preferences: Consumers worldwide are increasingly seeking healthier and more sustainable food products, forcing companies to adapt quickly.

Many competitors reported lower profits or revenue slowdowns under these conditions. Against this backdrop, Unity Foods’ turnaround appears even more significant.

Global Comparisons: Positioning Against Industry Leaders

To better understand Unity Foods’ performance, it helps to compare with global giants:

- Archer Daniels Midland (ADM) reported relatively stable revenues but lower net margins, citing supply chain costs.

- Bunge Limited managed revenue growth but faced higher financing costs, which weighed on net income.

- Wilmar International experienced revenue declines in some markets due to commodity price weakness.

In contrast, Unity Foods not only preserved revenue but also expanded margins and cut financing costs. This positions the company favorably relative to peers, at least in terms of operational recovery.

Investor Sentiment and Market Outlook

From an investor perspective, Unity Foods’ FY25 performance is encouraging. The recovery in EPS from negative territory to $1.37 per share provides tangible evidence of value creation.

However, investors will be cautious on a few fronts:

- Sustainability of Other Income: A large portion of profitability came from non-operational sources. Maintaining this in future years will be challenging.

- Global Volatility: Commodity price swings remain a structural risk.

- Regulatory and Compliance Costs: The sharp rise in other operating expenses highlights ongoing risks from policy and regulation.

Still, the positive trajectory suggests Unity Foods is on a stronger footing, which could bolster investor confidence and improve its long-term valuation.

Strategic Priorities for the Future

Looking forward, Unity Foods is likely to focus on several areas to sustain its growth:

- Diversification into Value-Added Products

Expanding beyond commodity-based sales into branded, value-added products will support margin stability. - Sustainability and ESG Commitments

Global investors and consumers are increasingly scrutinizing environmental and social governance practices. Unity Foods’ ability to demonstrate progress in sustainable sourcing will affect its competitiveness. - Geographic Expansion

Emerging markets in Asia and Africa present growth opportunities for consumer staples companies. - Digital Transformation

Leveraging technology for supply chain management, demand forecasting, and customer engagement will be critical. - Financial Discipline

Maintaining reduced finance costs and prudent capital allocation will provide stability.

Expert Commentary: Lessons from the Turnaround

Financial analysts note that Unity Foods’ turnaround is not just about recovering losses but about reestablishing a foundation for long-term growth. Several experts point out that the company’s ability to balance cost control with strategic investment is what made FY25 a success.

Others caution that global headwinds — from climate-driven crop volatility to rising protectionism in food exports — could test Unity Foods in FY26. To thrive, the company must not only replicate its operational efficiencies but also innovate in product lines and geographic reach.

Conclusion: A Stronger, Leaner Unity Foods

Unity Foods’ FY25 results tell a story of resilience and adaptability. From a staggering $3.52 billion loss in FY24 to a $1.63 billion profit in FY25, the company has executed one of the most impressive recoveries in the food and consumer goods sector.

With stronger gross margins, lower finance costs, and improved operational discipline, Unity Foods has reset its trajectory. Challenges remain — including volatile global markets and rising compliance costs